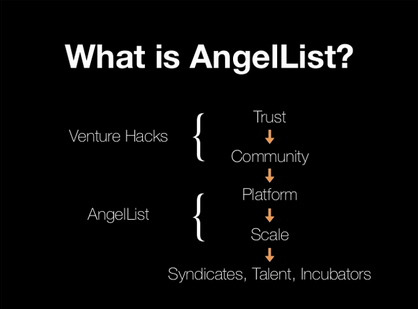

Mission and operations īusiness Insider dubbed AngelList the " for investors and startups". They announced the list as "AngelList" in 2010, with the subscription of 50 angel investors who intended to invest USD $80 million that year. Using the traction from the Venture Hack blog on entrepreneur financing, Naval and Babak started a list of 25 investors with whom they would share interesting companies to invest in.

Angel list stack serial#

History ĪngelList was founded in 2010 by serial entrepreneur Naval Ravikant and Babak Nivi. Created by serial entrepreneur Naval Ravikant and Babak Nivi in 2010, Avlok Kohli has been leading AngelList as its CEO since 2019.

Angel list stack free#

Since 2015, the site allows startups to raise money from angel investors free of charge. Founded in 2010, it started as an online introduction board for tech startups that needed seed funding. website for fundraising and connecting startups, angel investors, and limited partners. Product Hunt, Republic, CoinList, WellfoundĪpril 22, 2010 13 years ago ( ) in San Francisco, CAĪngelList is a U.S. They’ve moved on to the next hot deal.Entrepreneurship, Startups, Investments, Recruitment And the thing is, with the crazy pace these days, you won’t get a chance to explain or show more progress next month. Don’t hide the fact a key VP or even founder is quitting. They also need to look for flags and issues even faster than ever, too.

Don’t hide the challenges, issues, and cons.Others may disagree, but when you go in “hot”, make sure you can back it up. Don’t communicate super-high valuation expectations until you know you can.But it can backfire if you’re a startup where it may take more time to get to know. This can work really well again if you’re obviously fundable. Be careful about “running a process” and jamming all potential investors into a tight timeline.Ask your existing investors (if you have any) how you stack up.Otherwise, even in 2021, it won’t necessarily be any easier. Yes, the hottest SaaS companies are getting funded more quickly and at higher valuations than ever. If you aren’t - don’t overplay your hand. Just a few actionable thoughts if you plan to fundraise soon: While many more dollars are going into SaaS and Cloud startups - they aren’t really going into more startups. Battery Ventures’ data said the same thing from a different perspective. But they’re doing deals into (x) hot startups, (y) they already know, (z) with proven, top decile traction.įor the rest, it’s really not any easier to get funded than a year or two ago.

Funds like Tiger took advantage of this, often doing large deals in just a week. But most of the capital went into the top startups VCs already knew. Cloud went on a tear after things stabilized, post-Covid, and venture followed.

Angel list stack series#

Hot Series A, B, and D rounds are happening faster than ever: Valuations for seed-stage deals on AngelList were up 9% in 1Q21 compared to 2020. “Valuations rose across every stage of funding on AngelList - aside from pre-seed and Series C. For Series A+ rounds, valuations are higher than ever: A decline in valuation for pre-seed startup, and barely any movement at seed:īut for the hottest of startups, it’s a different story per Angelist. What about early stage? Well, here AngelList has terrific data, since so many start-ups are on its platform.Īnd what has Angelist seen? This. So net net, a ton more capital went into later-stage deals, but often into startups that did even better during Covid. But those that didn’t grow faster quietly struggled to raise at all. Sometimes at 2x-3x the valuation of just months before. The best SaaS companies grew even faster during Covid, and attracted even more capital. In fact, what really happened during Covid was a flight of capital to the top properties. We see hot earlier-stage startups out of top incubators getting funded at record valuations.īut, like with most things, it’s not quite that simple. We see emerging leaders like Brex quickly raise at $7B+ and ClickUp raise at $1B just months after raising at a fraction of those valuations.

It can be hard to tell from the media and Twitter just what’s happening in SaaS and Cloud startups these days.

0 kommentar(er)

0 kommentar(er)